Just How a Skillfully Crafted Financial Debt Monitoring Strategy Can Change Your Financial Circumstance

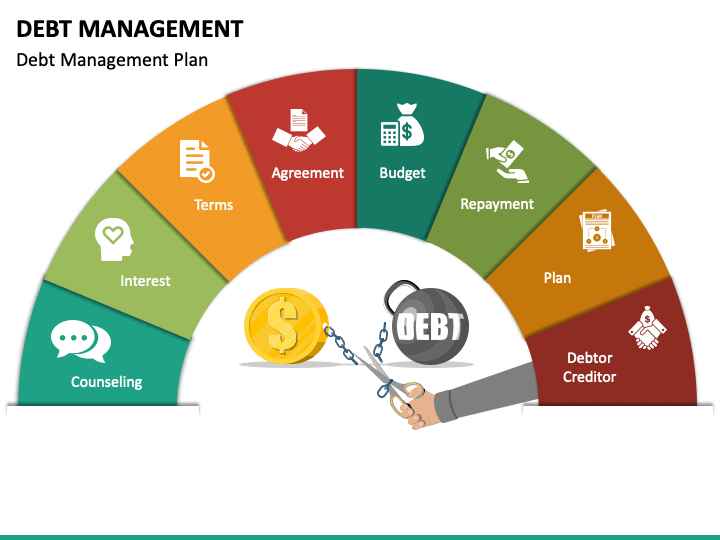

Among the difficulties that economic commitments existing, there exists a beacon of hope in the type of professionally crafted financial debt management plans. Through a combination of critical settlement, economic know-how, and organized planning, the transformative power of a well-executed financial obligation administration plan can be a catalyst for reshaping your economic future.

Advantages of a Professional Financial Debt Monitoring Plan

Involving an expert financial debt management plan can dramatically streamline the procedure of dealing with financial obligations with knowledge and effectiveness. Among the primary advantages of getting expert support is the tailored approach these professionals supply. By performing an extensive evaluation of an individual's financial circumstance, experts can craft a customized strategy that aligns with the customer's details requirements and goals. This personalized strategy boosts the chance of effectively managing and lowering financial debt.

Additionally, expert financial obligation management strategies commonly feature the advantage of reduced passion rates negotiated by the experts. With their sector understanding and recognized relationships with creditors, specialists can commonly safeguard reduced rates, leading to general cost savings for the individual. Furthermore, these plans usually incorporate an organized payment routine that is much more workable for the client, guaranteeing timely settlements and progress in the direction of financial debt reduction goals.

Customized Financial Technique

The development of a tailored economic strategy is crucial for effectively lowering and handling debt. A personalized economic method takes into consideration a person's distinct economic scenarios, goals, and difficulties. debt management plan singapore. By examining elements such as earnings, costs, assets, and financial debt commitments, an individualized strategy can be created to deal with specific requirements and top priorities

One key advantage of a personalized economic technique is its ability to offer a clear roadmap for attaining financial debt administration goals. By laying out workable actions and timelines, individuals can stay determined and focused in the direction of minimizing their financial debt problem. In addition, a tailored plan can also aid people make educated decisions concerning budgeting, conserving, and spending, thus enhancing overall financial health and wellness.

In addition, a personalized monetary technique can adjust to changing circumstances. Life occasions such as job loss, medical emergencies, or unforeseen costs can impact one's monetary circumstance. An individualized plan can be flexible sufficient to suit these adjustments while still functioning towards debt reduction and financial security. Inevitably, a customized economic approach offers as an effective device in changing one's economic scenario and attaining long-lasting success.

Lower Rates Of Interest and Charges

After establishing a customized monetary approach to resolve private financial obligation management requires, the next essential action entails checking out opportunities to lower rate of interest and charges. Lowering passion rates and costs can dramatically affect an individual's capacity to pay off financial debt successfully. One method to achieve this is by settling high-interest financial obligations into a solitary, lower rate of interest rate loan. Financial obligation combination can simplify month-to-month payments and minimize the general rate of interest paid, assisting individuals conserve money over time.

Negotiating with lenders is an additional reliable strategy to lower rate of interest and fees. Numerous financial institutions are willing to work out reduced rate of interest or forgo certain fees if approached skillfully. Choosing balance transfer provides with lower introductory prices can likewise be a wise action to lower passion prices momentarily.

In addition, dealing with a respectable credit report therapy company can supply access to financial obligation management plans that negotiate reduced rates of interest and charges with lenders on behalf site of the individual. These plans often feature organized payment schedules that make it easier for individuals to handle their financial obligation efficiently while conserving money on interest settlements. By proactively seeking means to reduced rate of interest and costs, individuals can take significant strides in the direction of boosting their economic wellness.

Debt Consolidation and Simplification

To enhance financial obligation settlement and improve financial company, checking out consolidation and simplification approaches is vital for people seeking reliable financial debt administration solutions. Loan consolidation involves incorporating several financial debts into a solitary account, frequently with a reduced rate of interest, making it simpler to take care of and potentially lowering overall prices. By consolidating financial obligations, people can simplify their regular monthly payments, making it less most likely to miss out on due dates and incur added fees. This technique can additionally assist in lowering the total amount of passion paid over time.

Simplification, on the various other hand, requires arranging financial resources in such a way that is simple to take care of and recognize. This might entail developing a spending plan, monitoring expenditures, and establishing economic goals to prioritize debt settlement. Streamlining economic their website issues can minimize anxiety and enhance decision-making relating to money management.

Improved Credit Score and Financial Health

Enhancing one's credit report score and general economic health is a crucial aspect of reliable debt administration and long-lasting economic stability. By combining financial debts, negotiating lower rate of interest prices, and creating a structured payment timetable, individuals can function in the direction of reducing their debt problem, which in turn favorably influences their credit scores score.

In addition, as people stick to the guidelines stated in a financial obligation management plan, they establish much better economic habits and discipline. This newfound financial obligation not only aids in removing current financial obligations but also sets a strong foundation for future financial endeavors. By complying with the customized strategies outlined in the plan, people can progressively restore their creditworthiness and overall financial health, leading the way for an extra flourishing and safe monetary future.

Verdict

Finally, a properly crafted financial debt administration plan can considerably improve one's economic scenario by supplying a customized strategy, reduced rates of interest and fees, consolidation of debts, and inevitably causing an improved credit history and general financial wellness. It is a structured approach to taking care of debts that can aid people regain control of their funds and work in the direction of a more secure financial future.

Via a combination of calculated negotiation, monetary know-how, and structured preparation, the transformative you could look here power of a well-executed financial debt administration strategy can be a catalyst for reshaping your monetary future.

To streamline financial obligation settlement and boost financial company, discovering combination and simplification methods is important for people looking for effective debt administration remedies.Enhancing one's credit rating score and general economic wellness is a pivotal element of efficient financial debt monitoring and long-term monetary security. By settling financial debts, negotiating lower rate of interest rates, and producing a structured payment routine, people can function in the direction of minimizing their financial debt worry, which in turn positively impacts their credit history rating.Moreover, as people adhere to the guidelines set forth in a debt management plan, they develop far better economic behaviors and technique.

Comments on “Expert Tips on Navigating Your Debt Management Plan Singapore Options”